Vanessa Sciarra of the National Foreign Trade Council will speak Tuesday during the October 30 - November 1 International Fastener Expo in Las Vegas.

Tag "tariffs"

During FIN’s 40 years covering the fastener industry, tariffs have made frequent headlines.

The additional tariffs take effect September 24, 2018, and initially will be in the amount of 10%. Starting January 1, 2019, the level of the additional tariffs will increase to 25%.

Taiwan fastener exports set records in export volume, price and value during the first half of 2018, ChinaFastener.Info reports. Fastener exports from Taiwan could see increased gains in the second half of 2018 if U.S. President Donald Trump applies additional tariffs of 10% on $200 billion worth of Chinese exports, including fasteners.

“Section 301 tariffs act as a tax, and effective immediately, the replacement costs of all of BBI’s imports of affected items will have increased by 10%. As a result, we have increased our pricing respectively to absorb the cost increase,” Brighton-Best International stated in a letter to customers dated September 18.

“Normally you find your injury, you file a case with the World Trade Organization, and they investigate,” Riggs explained to attendees of Pac-West’s autumn meeting in Whitefish, MT. “Currently, we have skipped the WTO and done our own investigation.”

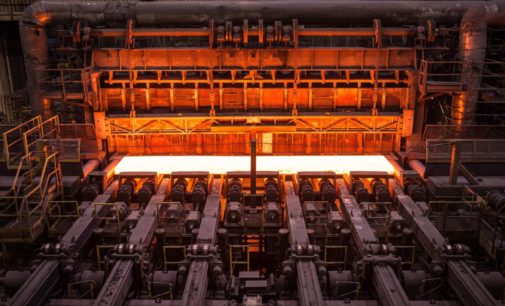

“Tense situation on raw material markets,” including U.S. steel and aluminum tariffs, trimmed first-half earnings.

The White House is considering additional tariffs of 10% on $200 billion worth of Chinese exports, including fasteners. If implemented, this third round of Section 301 tariffs would begin in September.

More denials than approvals amid reports that “large steel companies like US Steel (X) and Nucor (NUE) have tried to block many requests at the last minute, giving businesses that want exemptions little or no time to respond.”

Lawsuit comes amid news that Missouri-based Mid Continent Nail Corp. laid off 60 workers after losing 50% of its business in the first two weeks of June.

News that the European Union will apply 25% “rebalancing” tariffs on a range of products imported from the U.S., including seven categories of fasteners, comes amid reports that the U.S. Commerce Department is scrambling to assemble a team to evaluate thousands of exclusion requests.

Steel and iron nuts (HS code 73181600) were excluded from a list of Chinese products subject to a 25% tariff by the Trump administration under Section 301 of the Trade Act of 1974.

“Panic buying” among problems Kerr, Cincinello, Herbst and Hunt discuss at Mid-West Fastener Association meeting.

"As markets recovered and importers returned to long range, longer lead time sourcing, purchasing refocused on Taiwan from which imports continued to grow – even after the antidumping duties on China were repealed," according to Fastener + Fixing executive editor Phil Matten.

“Raw material prices and lead times were already increasing (25% - 40%),” the Industrial Fasteners Institute’s Washington representative Jennifer Baker Reid told GlobalFastenerNews.com. “This will make matters worse.”

Currently all nuts (HS code73181600), including inch, metric, and locking nuts, are on the list of goods that will receive the 25% duty announced by the White House.

In addition to the looming 232 tariffs on steel and aluminum, the fastener industry is also grappling with the fallout from an additional set of tariffs that could place a 25% tariff on all imported nuts.

Southwestern Fastener Association panelists agreed U.S. steel and aluminum tariffs are not creating jobs – just price increases.