Phase one deal leaves 25% tariffs on bolts, screws and other fasteners manufactured in China, as well as 15% tariffs on all iron and steel nuts.

Tag "tariffs"

Have a customs broker? It isn’t cover for you if U.S. Customs arrives at your office, Danielle Riggs cautioned the National Fastener Distributors Association. “One hundred percent is on the importer,” explained the director of international compliance for Würth Industry North America.

The new exclusion request process indicates U.S. tariffs on Chinese fasteners and other products are unlikely to be removed or reduced for at least the next 12 months.

More tariffs could be coming: The October 5% increase is ‘still pending’ and December could bring determination on threaded rod and stud tariffs.

Importers turning to “tariff engineering” to lower costs. “Everybody is looking for everything,” the attorney told the 2019 International Fastener Expo conference.

Numerous domestic fastener manufacturers are promoting their U.S. operations in advertising, but there are varying responses to whether or how much the tariffs are boosting domestic sales.

Twelve hours after China said it would retaliate against U.S. President Donald Trump’s next round of tariffs by raising taxes on American goods, Trump said he would bolster existing tariffs on $250 billion worth of Chinese goods to 30% from 25% on Oct. 1, including duties on bolts, screws and other fasteners manufactured in China. Trump also said the U.S. would tax another $300 billion worth of Chinese imports at a 15% rate, which includes all iron and steel nuts (HTS subheading 7318.16.00) imported from China.

On August 13, the Trump administration delayed imposing a 10% import tariff on electronics and other consumer goods, Reuters reports. The administration is still moving forward with 10% tariffs on much of the $300 billion of Chinese imports, including all iron and steel nuts (HTS subheading 7318.16.00) imported from China.

The new 10% tariff applies to all iron and steel nut imports (HTS subheading 7318.16.00) from China, as well as iPhones and most consumer goods.

Companies requesting exemptions must demonstrate that the product is available only from China, that the tariff will cause severe economic harm and that the product is "strategically important."

“Increased export tax rebates will help lower costs for China-based exporters, many of whom have been hit by US tariffs and significant economic uncertainty,” ChinaFastener.Info reports.

The original tariff of 10% will continue for a “substantial period of time because we have to make sure that if we do the deal with China that China lives by the deal,” U.S. President Donald Trump stated in late March.

South Africa notified the WTO of investigation, which started March 1. Interested parties have 20 days to submit information.

The U.S. Trade Representative’s office said it would move to formally suspend a scheduled tariff increase on Chinese goods “until further notice,” Reuters reports.

Steel threaded rod, bar, or studs subject to these investigations are non-headed and threaded along greater than 25% of their total actual length and produced in China, India, Taiwan and Thailand.

“It’s caused us major, major chaos,” Dexter Fastener Technologies VP Jim Cremering told The Detroit News. "We got exemptions for some, but not others. It doesn’t make sense.”

Section 301 tariffs of 10% on $200 billion worth of Chinese goods, including a majority of fasteners manufactured in China, were scheduled to increase to 25% on January 1, 2019.

“The automotive and equipment associations work hard,” stated Vanessa Sciarra, VP for legal affairs and Trade & Investment Policy for the National Foreign Trade Council. “They are your best friends.”

“The automotive and equipment associations work hard,” stated Vanessa Sciarra, VP for legal affairs and Trade & Investment Policy for the National Foreign Trade Council. “They are your best friends.”

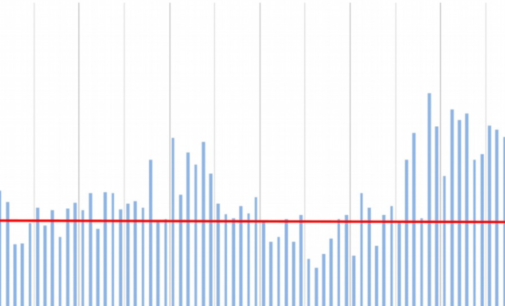

Sales and hiring increased during the month, while customers expressed uncertainty about future orders due to U.S. tariffs.