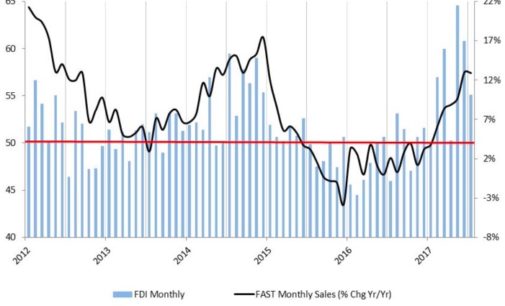

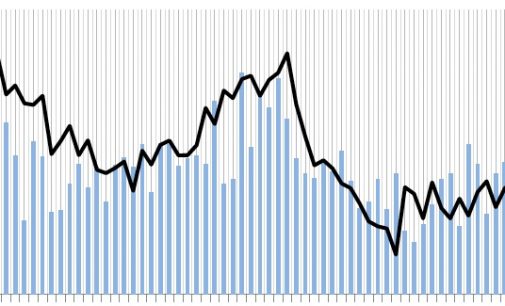

Commentary “again skewed largely positive” overall. One respondent indicated “sales are up 15% YTD.”

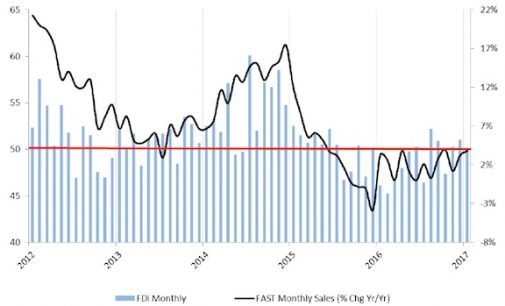

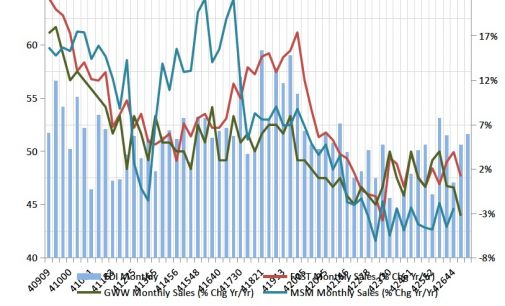

Tag "FDI"

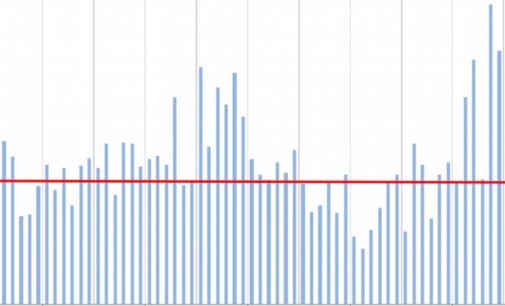

“In the January survey, a full 82% of respondents indicated sales were ‘better’ relative to seasonal expectations – the highest percentage recorded since FDI inception,” according to R.W. Baird analyst David Manthey.

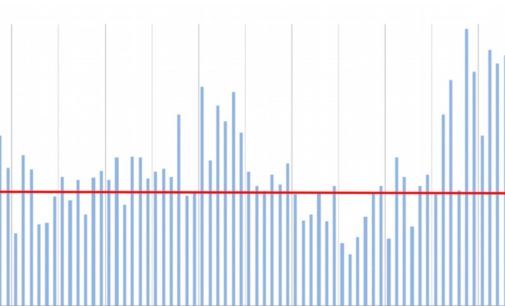

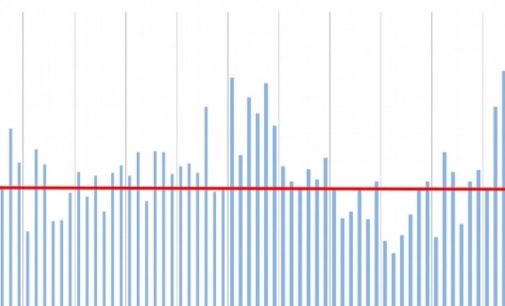

The Fastener Distributor Index rose “modestly” to 57.6 in December, reversing the deceleration seen in November, according to R.W. Baird analyst David Manthey.

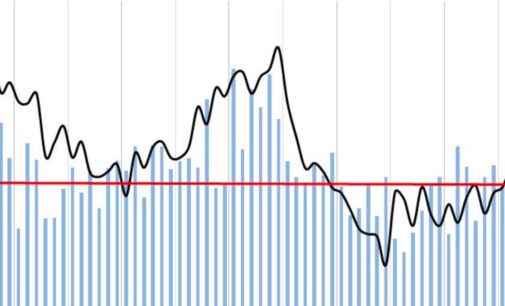

“In the November survey, 50% of respondents indicated sales were “better” relative to seasonal expectations – down vs. a record 73% in October but nevertheless still much improved vs. average 2016 levels (31%).”

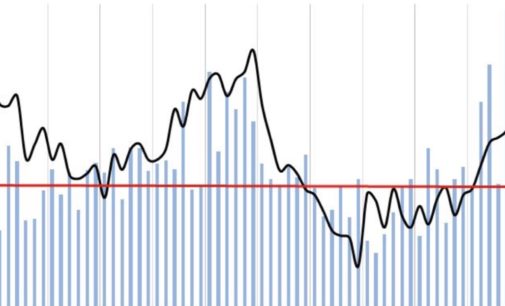

“Qualitative commentary on market conditions was again mostly positive with respondents noting strong demand, generally favorable end-market conditions, and a healthy pricing environment.”

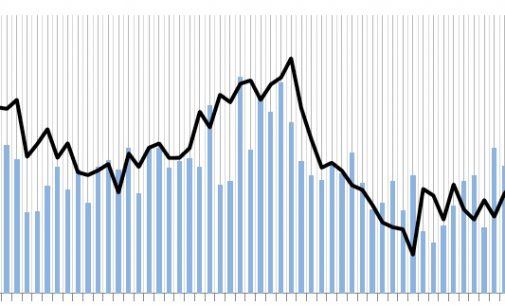

The Fastener Distributor Index for September dipped slightly to 61.5, “with sales trends remaining very strong,” writes R.W. Baird analyst David Manthey.

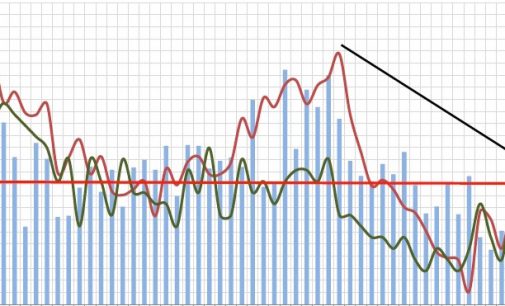

“Market conditions appear likely to remain in growth mode in the coming months,” writes R.W. Baird analyst David Manthey.

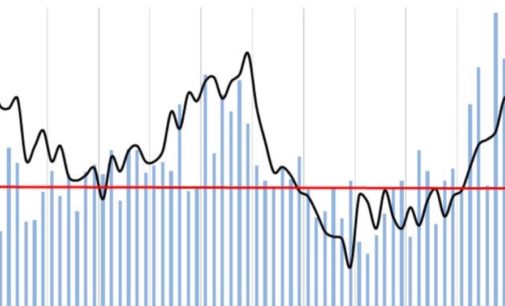

The seasonally-adjusted July FDI (55.1) ticked down from June’s strong 60.8 reading, “mainly driven by a slight moderation in sales momentum relative to a record June,” writes R.W. Baird analyst David Manthey.

“Commentary on market conditions remains positive, with respondents indicating selling conditions are strong and customer activity/backlog continues to suggest a favorable outlook.”

“[May was the] best month of sales in the past 18 months and increased backlog tells me it may happen again in June,” stated one respondent.

“Although not universal, commentary on current market conditions was mostly positive, as several respondents noted strong y/y and m/m sales growth, as well as favorable end-market dynamics.”

“Although not universal among respondents, most survey commentary was optimistic that market conditions could show improvement in 2017.”

“While industrial markets are showing encouraging signs of potential stabilization and increased optimism, the FDI indicates that current conditions remain choppy with relatively weak demand, competitive conditions, and pricing pressure continue to weigh on results before policy changes can be implemented,” noted R.W. Baird analyst David J. Manthey.

Top-line sentiment remained mostly positive for December, as 67% of respondents saw better or unchanged sales but did decelerate slightly vs. November (74%).

June results benefitted from a slight uptick in sales, while the sequential point-of-sale pricing index marked the third consecutive month of expansion.