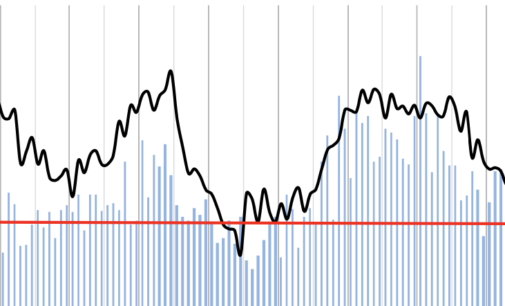

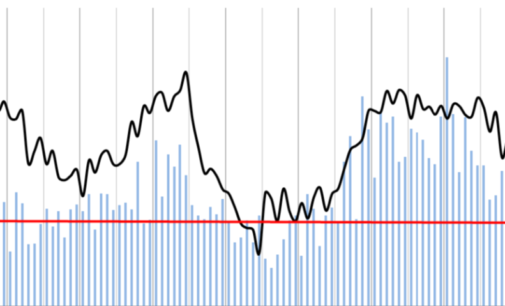

Strong sales, distributor inventories and pricing meet lower employment and customer inventories.

Tag "FDI"

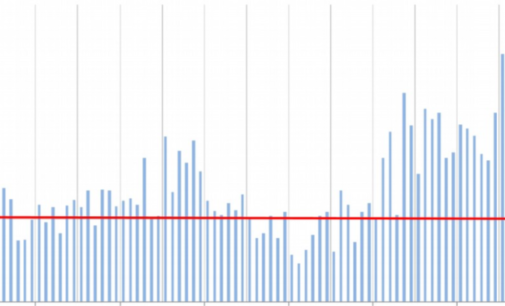

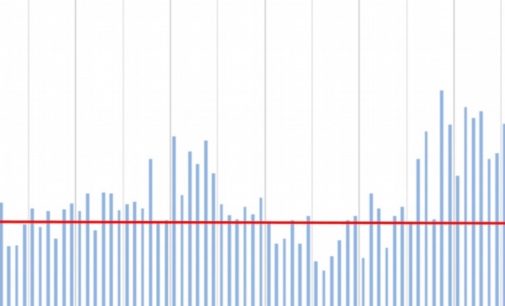

The seasonally adjusted March FDI (44.4) experienced a sharp contraction (February 53) “as the COVID-19 pandemic and ensuing shutdowns took hold over the latter half of the month,” R.W. Baird analyst David Manthey wrote.

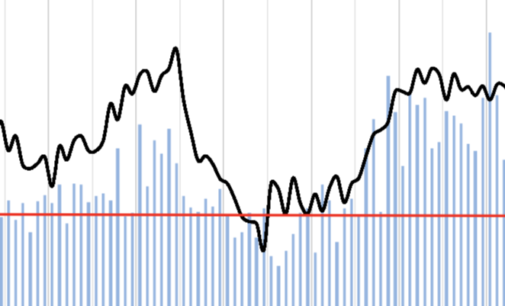

“Of note, the improvement in the sales index was driven mainly by the seasonal adjustment factor, as the percentage of respondents seeing better-than-expected sales actually decreased vs. last month, although this is not usual given February is normally a seasonally weaker month,” R.W. Baird analyst David Manthey wrote.

About 53% of respondents saw sales growth above seasonal expectations, while 23% characterized sales as below seasonal expectations.

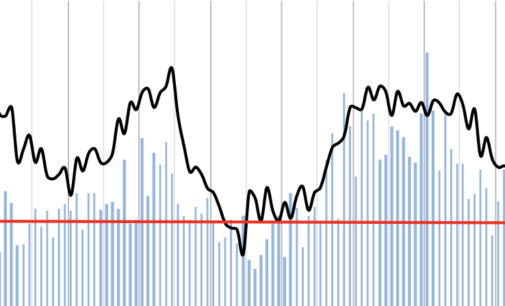

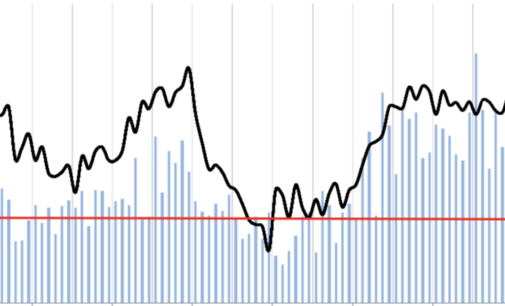

For the second consecutive month, 56% of respondents saw sales growth below seasonal expectations, while just 19% characterized sales as above seasonal expectations.

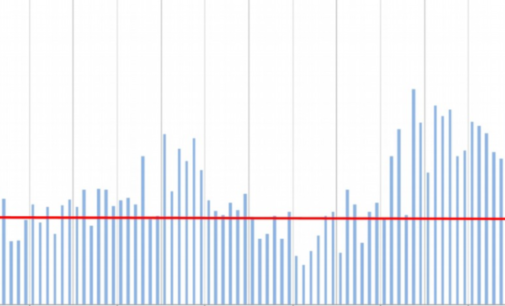

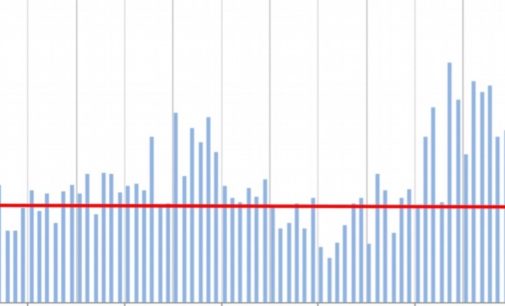

“Sales trends were slightly improved on an unadjusted basis, but the seasonal-adjustment factor drove the sales index down (month-to-month),” according to R.W. Baird analyst David Manthey.

“Better sales trends were offset by a weaker employment reading,” according to R.W. Baird analyst David Manthey.

“Better sales trends and a slight improvement in the employment index were the main contributors of the improvement,” according to R.W. Baird analyst David Manthey.

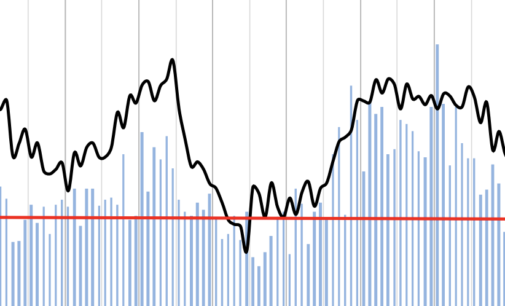

“A slight uptick in the percentage of respondents perceiving customer inventory levels as 'too low' was the primary driver of the recovery,” writes R.W. Baird analyst David Manthey.

“Sales trends rebounded nicely from weak March trends, which saw a contractionary sales reading,” according to R.W. Baird analyst David Manthey.

“Stabilization or further moderation in the FDI could be more likely than acceleration from here,” according to R.W. Baird analyst David Manthey.

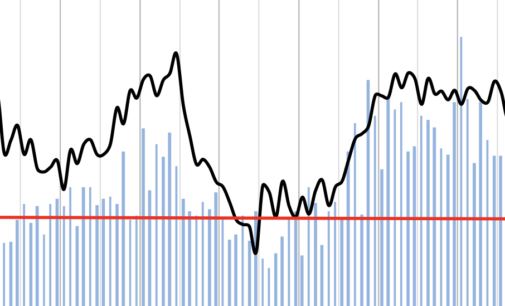

Several respondents expressed “cautious optimism” for a potential resolution to the US-China trade dispute. Pending any resolution, however, tariffs continue to impact lead times and pricing.

Sales trends improved in December, with 42% of respondents indicating sales were “better” relative to seasonal expectations vs. 34% of respondents the previous month.

November Fastener Distributor Index decelerates on weaker sales trends.

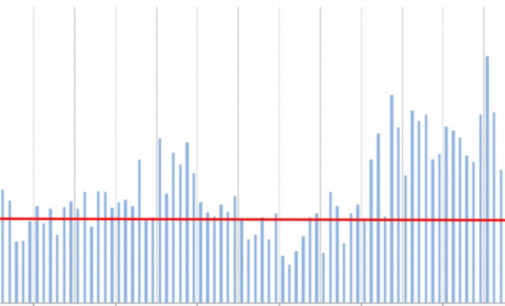

Sales and hiring increased during the month, while customers expressed uncertainty about future orders due to U.S. tariffs.

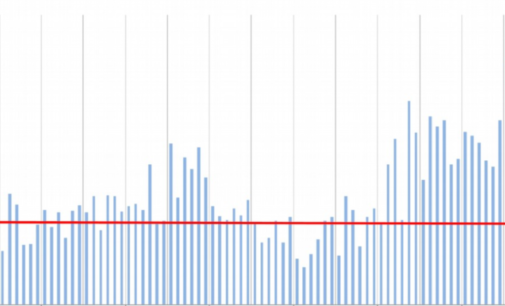

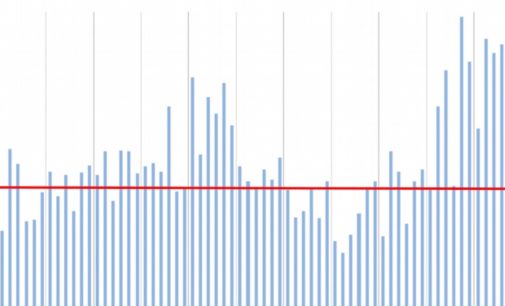

The seasonally adjusted September FDI (55.8) decelerated in September, “still strong in absolute terms but nonetheless meaningfully lower for the second straight month,” according to R.W. Baird analyst David Manthey.

“The overall tone of qualitative commentary was again more cautious this month, with respondents expressing some tariff-related uncertainty, and the potential for a loss of momentum,” writes R.W. Baird analyst David Manthey.

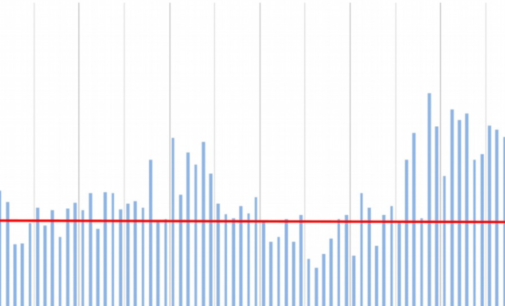

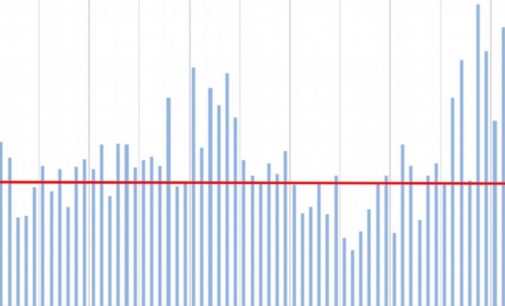

After four straight months of decline, the FDI regains its footing amid pricing gains and a stronger outlook for the coming months.

Qualitative commentary on market conditions was very positive regarding demand, while steel tariff impacts remain a topic of heavy discussion among respondents.

Commentary on market conditions was mixed, with some respondents commenting on the current strong demand environment and others expressing concerns around the recently announced steel tariffs.