Stock Report: ITW

FIN STOCK REPORT

Stock Report: ITW

![]()

2014

ITW reported automotive OEM organic revenue growth of 7% outpaced fourth quarter worldwide auto builds of 1%. Organic revenues grew 12% in Europe, 4% in North America and 7% in Asia Pacific. Operating margins of 22.3% increased 190 basis points.

Automotive OEM revenue, including fasteners, totaled $620 million in Q4, with operating income of $138 million and an operating margin of 22.3%.

Construction Products revenue, including fasteners, totaled $402 million, with operating income of $63 million and an operating margin of 15.7%.

Overall Q4 declined 1.4% to $3.5 billion. Operating income rose 9.5% to $686 million, with net income up 10.3% to $450 million.

Full-year Automotive OEM segment revenue reached $2.6 billion, with operating income of $600 million.

Full-year Construction Products segment revenue totaled $1.7 billion, with operating income of $289 million and an operating margin of 17%.

ITW reported Automotive OEM segment revenue, including fasteners, declined 2.2% to $653 million in the opening quarter of 2015, despite a 7% organic increase in sales. Organic revenues increased 13% in Europe, 3% in North America and 14% in China.

Construction Products revenue, including fasteners, declined 8% to $381 million, with sales in North America up 5%, sales in Asia Pacific and Europe up 1%. Segment operating margin improved 180 base points to 16.6%.

Illinois Tool Works Inc. reported total revenues grew 4% to $3.6 billion in the opening quarter of 2014, with operating income increasing 16% to $667 million. Organic revenue gained 3.3%, with international revenue up 6.3% and North American sales improving 1%.

Operating margins of 18.7% increased 180 basis points, with enterprise initiatives contributing 120 basis points.

Automotive OEM organic revenue, including fasteners, grew 13% in Q1 – “significantly” outpacing worldwide auto builds of 5%. Segment organic revenues grew 11% in North America, 14% in Europe and 28% in China. Operating margins of 23.3% increased 350 basis points.

Construction Products’ organic revenues, including fasteners, grew 5% due to 14% growth in Asia Pacific and 1% growth in Europe. In the U.S., organic revenues rose 7% in the residential category, while the renovation category was flat and the commercial construction category declined 8%. Segment operating margins of 14.8 percent increased 310 basis points.

ITW raised its full-year EPS guidance to a range of $4.45 to $4.65, with the $4.55 mid-point representing a 25% increase versus 2013. Total revenue is expected to grow in the range of 3% to 4%. For the 2014 second quarter, ITW is forecasting EPS to be in a range of $1.16 to $1.24 and expects total revenue growth in a range of 3% to 5%.

2013

ITW Automotive OEM segment sales, including fasteners, grew 10.4% to $2.4 billion in 2013. Worldwide automotive base revenue growth of 9.5% in 2013 exceeded auto builds of 4% primarily due to worldwide product penetration gains.

International automotive base revenues rose 10.9%. Base revenues for Asia Pacific increased 20.8% due to revenue growth in China of 37.7% — more than double Chinese auto build growth of 14%. European base revenue growth was 6.8% while auto build growth was flat.

North American automotive base revenue growth of 8% exceeded auto build growth of 5%.

Construction segment revenue, including fasteners, was flat at $1.7 billion, while segment operating margin grew to 13.9%. U.S. renovation revenue grew 7.3% due to strong tool sales and higher sales to big box retailers. U.S. commercial revenues fell1.4%.

International base revenues declined 1.6% as EU base revenues fell 5.3%. Base revenues in Asia rose 2.4%.

Specialty Products revenue, including fasteners, gained 7.3% to $2 billion, with operating margin of 20.3%.

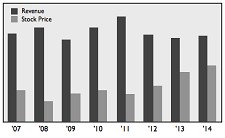

Overall ITW revenue declined 4.4% to $14.1 billion in 2013, with operating income growing 1.6% to $2.5 billion.

2012

ITW reported its Transportation segment, including fasteners, “delivered strong organic growth despite the difficult macroeconomic environment” in 2012.

Revenues increased 3.1% to $3.55 billion, due to increased base business and revenues from acquisitions. Worldwide automotive base revenues increased 9.4% due to an increase in worldwide auto builds of 6%, favorable customer mix and product penetration gains in Europe, and growing product penetration with OEMs in China.

International automotive base revenues increased 10.2%, boosted by a 5% gain in European auto builds and increased product penetration. Asian automotive base revenues rose 20.8% on improved product penetration.

Transportation segment operating income grew 3.8% to $560 million primarily due to the positive operating leverage effect of the base revenue increase and acquisition income, partially offset by higher restructuring expenses.

Construction segment revenue, including fasteners, declined 3.4% to $1.9 billion as European base revenues declined 5.1% due to lower sales of consumable products driven by a slowdown in construction activity.

In North America, base revenue growth for residential, renovation and commercial construction was 9.5%, 5.6% and 4.1%, respectively. The North American base revenue increase was driven by improved U.S. housing starts as well as a modest increase in commercial construction.

Construction segment operating income declined 0.5% to $200 million.

ITW marked its 100th anniversary in 2012.

ITW reported total revenues grew 0.9% to $4.65 billion in the second quarter of 2012, hindered by negative currency translation. Operating income gained 8.3% to $770 million.

Organic or base revenues grew 2.3%, with North American organic revenues increasing 5.3% and international organic revenues declining 0.8%. European organic revenues decreased 1.7%. Asia Pacific organic revenues “underperformed company expectations,” growing only 1.8%. Notably, China organic revenues declined 0.5%.

Six-month revenue grew 3.5% to $9.2 billion, with operating income improving 7.7% to $1.47 billion.

Transportation

Transportation segment revenues, including fasteners, edged up 0.1% to $896 million in Q2, which included 3.4% organic growth negated by currency translation. Segment operating income gaining 4.4% to $143 million for the period.

Transportation segment results were boosted by a 6% rise in global auto builds, which included an 8% increase in the U.S. and a 24% rise in Asia. However, auto aftermarket revenue declined 2% as consumer spending softened.

Transportation segment revenue in the first half of 2012 rose 4.9% to $1.82 billion — including organic growth of 4.2%. Operating income gained 7.3% to $294 million for the six-month period.

Construction

Construction Products revenues, including fasteners, fell 6% to $489 million in Q2, despite an 8% increase in North American revenue as residential, commercial and renovation markets all achieved positive results. Outside the U.S., construction revenue declined 4%. Q2 segment operating income fell 7.8% to $59 million.

Six-month Construction Products revenues declined 2.5% to $958 million, while operating income dropped 13.6% to $95 million.

2011

ITW reported revenues for the Transportation segment, including fasteners, increased 23.2% to $3.1 billion in 2011 due to the increase in base business, revenues from acquisitions and the favorable effect of currency translation.

North American automotive base revenues increased 9.8% in 2011 due to domestic auto build growth of 10%. International automotive base revenues increased 10.2%, boosted by a 5% gain in European auto builds and increased product penetration. Asian automotive base revenues rose 20.8% on improved product penetration and higher auto builds in China and India.

Transportation segment operating income climbed 28.5% to $474.6 million.

Construction segment revenue, including fasteners, improved 11.7% to $1.96 billion. European base revenues increased 6.9% on improved conditions in commercial construction. North American base revenues increased 2.3% primarily due to price increases. In North America, renovation base revenue growth was 5.5%, residential base revenue growth was 2.7% and commercial construction base revenue declined 3%.

Construction segment operating income increased 17.4% to $225.4 million.

Overall ITW revenue rose 15.4% to $17.8 billion in 2011, with operating income up 21% to $2.73 billion. The U.S. market produced 48% of overall revenue, while 33% came from Europe, the Middle East and Africa. The remaining 19% was produced in Asia.

ITW marked its 100th anniversary in 2012.

ITW reported Transportation segment revenue, including fasteners, grew 22.7% to $805.6 million in the second quarter of 2011, while segment operating income climbed 15% to $119.7 million and margins dropped 0.9% to 14.9%.

North American base revenues increased 6.6%, compared with 1% growth in domestic auto builds, and international base revenues gained 8.2%, compared to 4% growth in European auto builds.

The global auto aftermarket worldwide base revenues improved 1.3% “due to the rise in gas prices and lower miles driven.”

Construction segment revenue, including fasteners, gained 11.7% to $519.9 million during Q2, boosted by a 6.1% base revenue growth in Europe. Q2 construction segment operating income dropped 4.7% to $64.3 million, while margins dipped 2.1% to 12.4%.

Consolidated operating revenues at ITW gained 17.5% to $3.93 billion, while operating income gained 13.6% to $626 million and net income jumped 21.1% to $411.5 million.

2010

ITW reported revenues for the Transportation segment, including fasteners, grew 23.6% in the first quarter of 2011, “largely due to ongoing strength in automotive OEM car builds as well as new product penetration.”

While worldwide automotive OEM organic revenues grew 15.7% in the first quarter, North American and European car builds increased 11% versus the year-ago period. Segment operating margins of 15.9% improved 80 basis points.

Overall Q1 revenues grew 17.4% to $4.4 billion.

Q1 operating income of $682.6 million increased 26% and net income grew 86% to $623.1 million.

Consolidated revenue gained 14.4% to $15.9 billion in 2010, while operating income jumped 70% to $2.35 billion.

Transportation segment revenue rose 22% to $2.52 billion, while construction revenue improved 14.7% to $1.75 billion.

2009

With “virtually all OEMs boost(ing) production,” ITW reported sales at its Transportation segment, including fasteners, increased 9.6% to $593.1 million during the fourth quarter of 2009. Transportation operating profit nearly quadrupled to $88.8 million “as Q4 auto builds significantly ramped up in Europe and North America,” improving margins to 15%.

European auto builds jumped 30% to 5.1 million units in the fourth quarter, while North American auto builds gained 15% to 2.7 million units.

Construction segment sales, including fasteners, grew 4% to $432.3 million during Q4, while operating income gained 13.5% to $42.6 million.

Consolidated revenue fell 18.8% to $13.877 billion in 2009, while net income declined 37% to $947 million.

ITW continues to post strong results, with revenue during the opening quarter of 2010 rising 14.6% to $3.06 billion, including a 35% jump in Transportation sales. Net income in Q1 more than quadrupled to $483.9 million.

In January 2010 ITW acquired UK-based specialty coatings maker ICI-Imagedata. The new business unit is called ITW Imagedata and reportedly employ about 50 workers. Imagedata was founded in 1988 and is led by general manager Ian Stephenson.

2008

Starting in 2008 ITW reports its fastener results in two segments: Transportation and Construction Products.

Transportation revenue in 2008 grew 6% to $2.35 billion, boosted by acquisitions. Base revenues for North America declined 15.2% primarily due to a 21% cut in automotive production by the Detroit 3 and a 10.1% reduction by new domestic automotive manufacturers.

International base automotive revenues declined 6.3%Segment operating profit declined 25% to $277.6 million.

Construction Products revenue dipped 3.6% to $1.99 billion, with operating income slipped 15.9% to $238.1 million.

Base revenues declined 14.6% in North America and 7% in Europe, while sales for the Asia Pacific region grew 4.4%.

Full-year sales increased 7% to 15.9 billion, while operating income dropped 4% to $2.34 billion, with further losses predicted.

“We expect base revenues to be down in the range of 6 to 12% for full-year 2009,” the company stated.

ITW was awarded Keep America Beautiful’s 2008 Vision for America Award for its recycling programs, employee volunteerism, and financial support of environmental organizations. Specifically mentioned was ITW’s minimal packaging approach, with its focus on sustainable packaging.

“Reducing packaging waste, and selecting sustainable materials has not only helped to protect the environment, but helped ITW customers to save money through reduced shipping costs, streamlined operations, and materials recovery through recycling and reuse,” the group stated.

HISTORY

ITW entered the fastener business in 1923 using a patent on a twisted-tooth lockwasher to start Shakeproof Company in 1923, when Detroit was converting from wood to metal car door hinges.

Fastener involvement expanded with the concept of “preassembling” a washer to a screw.

Today ITW manufactures highly engineered fasteners and industrial components and specialty products primarily for the auto, food and construction industries. Brand names include Buildex, Fastex, Ramset/Red Head and Shakeproof.

Corporate Office: 3600 W. Lake Ave., Glenview, IL 60025-5811.

Tel: 847 724-7500 Fax 847 657-4392

Web: itw.com

CEO: E. Scott Santi

Employees: 49,000

©2015 GlobalFastenerNews.com

There are no comments at the moment, do you want to add one?

Write a comment