Stock Report: HILLMAN

FIN STOCK REPORT

![]()

2014

Hillman Companies announced the retirement of James Waters as CEO and as a member of the Board of Directors after nearly 16 years of service. Hillman appointed Doug Cahill, its current non-executive chairman, as executive chairman.

Waters was named CEO in July 2013, taking over for the retiring Mick Hillman.

In May 2014, CCMP Capital Advisors, LLC agreed to acquire a controlling interest in Hillman from Oak Hill Capital Partners in a transaction valuing the company at $1.48 billion. CCMP is partnering with Hillman’s current management team, led by former CEO Jim Waters.

Oak Hill Capital will retain a significant minority interest in the company.

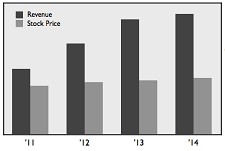

In 2014, Hillman reported revenue of $734.7 million.

Fasteners generated approximately 64.5% of the Company’s total revenues in 2014.

2013

In 2013, Hillman Companies Inc. acquired H. Paulin & Co. Ltd. for $103.4m. Hillman paid CDN $27.60 per share to purchase the Canadian fastener manufacturer. The deal represents a premium of approximately 116% to the 20-day volume weighted average price of Paulin shares.

Paulin president Richard Paulin will continue as president of H. Paulin, a division of Hillman Canada.

Paulin’s distribution facilities are located in Vancouver, Edmonton, Winnipeg, Toronto, Montreal and Moncton, as well as in Flint, MI, and Cleveland, OH. Paulin’s four manufacturing facilities are located in Ontario.

Full-year Hillman revenue rose 26% to $701.6 million, boosted by acquisitions. The company reported a net loss of $1.14 million in 2013, compared with a $7.2 million loss the previous year.

During 2013 Hillman named executive vice president and COO James Waters to succeed Max “Mick” Hillman as CEO, effective July 1, 2013. Waters also joined the Hillman board.

Max Hillman, who retired as CEO after 44 years with the company, retained a board seat.

Hillman grew his father’s hardware distributorship into an international value-added distributor serving multiple retail channels and product categories.

Waters joined Hillman in 1999 as CFO and was promoted to EVP/COO in 2011.

During his tenure as COO, Hillman made its largest acquisition to date, H. Paulin & Co.

Founded in 1920, Paulin supplies 41,000 standard fasteners and manufactures custom cold-headed products, metal stampings, screw machine products, self-locking fasteners and custom parts for the automotive, agricultural, electronics and appliance industries. Paulin also produces stainless and nonferrous fasteners.

Manufacturing processes include cold heading, nut forming, metal stamping, screw machine, adhesive coating and packaging.

Distribution facilities are located in Vancouver, Edmonton, Winnipeg, Toronto, Montreal, Moncton and Cleveland, Ohio.

Divisions include Jeyco Machine Products, Precision Fasteners, Long-Lok Canada, Capital Metal Industries, Dominion Fittings, Paulin Industries and Pro-Tip.

Trademarks include Paulin, Papco, Easy-Spot, Work Savers, Loxxon, Pie-a-Pae, Uni-Bolt, Uni-Nut, Pro-Tip, Contractor Quality and Dominion.

2012

Hillman Companies Inc. acquired H. Paulin & Co. Ltd. for CDN $103 million (US$104.5m) in 2013.

Full-year sales at Hillman increased 9.6% to $555.6 million, with a net loss of $7.2 million.

2011

H. Paulin reported sales increased rose 4% to $139.3 million during 2011, while operating income rose 21% to $5.45 million and net income gained 23% to $3.9 million.

Full-year earnings per share gained 22.6% to 1.19.

Distribution sales grew 6% to $120 million. The growth was attributable to increased industrial OEM sales (primarily in the agricultural market), as well and industrial distributor business tied to the energy and natural resources markets; double-digit growth in the automotive aftermarket as a result of the introduction of new products and market share growth; and new product introductions for the retail hardware market.

“Growing competitive pressures in the industrial distributor market from U.S. competitors combined with higher levels of direct importing by some distributors negatively impacted the growth within this market,” the company stated in its annual report.

Manufacturing sales dropped 1% to $30.2 million, reflecting several automotive OEM parts being eliminated due to platform build-outs, a more competitive marketplace and Paulin’s strategy “not to pursue new low margin automotive business.”

“Our manufacturing segment continued to progress in 2011 making a small profit and reducing their dependence on the automotive market.”

Since 2007, this segment has reduced sales to the automotive tier 1 and 2 suppliers by over $15 million.

Export sales increased 3% to $13.1 million in 2011.

Investments in the distribution business, which included racking, warehouse equipment and building leaseholds, decreased by $765,000 in 2011, while investments in the manufacturing segment declined by $120,000 to $204,000. The main areas of 2011 spend were on production machinery.

In 2012 Paulin expects to focus on sales to OEMs and the automotive aftermarket.

2010

H. Paulin reported sales increased 8.5% to CAD 133.84 million during 2010, while operating income rose 45% to CAD 4.17 million and earnings per share gained 16% to .86.

Fourth quarter sales grew 6.2% to CAD 30.46 million, while Q4 income soared 40% to CAD 198,000. Q4 earnings per share dipped 10% to .09.

No dividend was declared for the period.

2009

H. Paulin reported sales decreased 10% to CAD 123.1 million during 2009, while operating income rose 20% to CAD 3.4 million and net income rose to CAD 2.4 million compared to a CAD 700,000 loss the previous year.

Fourth quarter sales slipped 3% to CAD 29.42 million, while Q4 income declined to a loss of CAD 2.6 million, compared to a CAD 535,000 loss during the final quarter of 2008.

Paulin reported net sales dropped 23% to CAD 26.22 million (US$22.3 million) in the first quarter of 2009, resulting in a net loss of CAD 192,000 compared with a $6,000 profit during the opening quarter of 2008. The board of directors did not declare a dividend for the period.

In 2008 Paulin appointed Murray Mateyk, 48, to the newly created position of CFO. Mateyk, a chartered accountant, reports to company president Richard Paulin.

2008

Despite the automotive downturn, H. Paulin reported sales rose 2% to CAD 138.2 million during 2008, though the Canadian fastener manufacturer tallied a yearly net loss of CAD 729,000 compared with a CAD 1.8 million profit for 2007.

Paulin recorded charges of $3.1 million in the fourth quarter “due to the significant downturn in the automotive sector.”

Fourth quarter sales slipped 3% to CAD 29.42 million, while Q4 income declined to a loss of CAD 2.6 million, compared to a CAD 535,000 loss during the final quarter of 2007.

In 2008 Paulin appointed Murray Mateyk, 48, to the newly created position of CFO. Mateyk, a chartered accountant, reports to company president Richard Paulin.

HISTORY

Founded in 1964 Cincinnati-based Hillman distributes fasteners, key duplication systems, engraved tags and related hardware items to 20,000 retail customers in the U.S., Canada, Mexico, South America and Australia, including home improvement centers, mass merchants, national and regional hardware stores, pet supply stores and other retailers.

Fasteners are the core of Hillman’s business and the product line encompasses more than 105,000 SKUs. The fastener line includes standard and specialty nuts, bolts, washers, screws, anchors, and picture hanging items. Hillman offers zinc, chrome, and galvanized plated steel fasteners in addition to stainless steel, brass, and nylon fasteners in this vast line of products.

Corporate Office: 10590 Hamilton Ave., Cincinnati, OH 45231.

Tel: 513-851-4900

Web: hillmangroup.com

CEO: Jim Waters, retired in April 2015

Employees: Over 2,605

©2015 GlobalFastenerNews.com

There are no comments at the moment, do you want to add one?

Write a comment