FDI: Fastener Distributors Face Continued Pressure

3/3/2016 1:06:00 PM

FEATURE

FDI: Fastener Distributors Face Continued Pressure

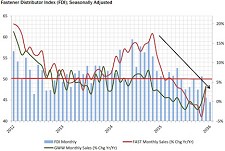

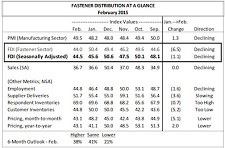

The February Fastener Distributors Index contracted, falling to 44.5 from 45.6 in January, “reflecting what we believe remains a strained environment for both distributors and manufacturers.”

Sales growth among survey participants dipped incrementally, with just 28% of respondents citing stronger results versus January.

“Of the items measured (sales, employment, delivery times, inventories, customer inventories), we believe weaker top-line sentiment remains the most compelling indicator in the Index.”

Additionally, the employment component of the FDI (44.8) ticked lower in February, as 90% of participants noted unchanged or reduced hiring conditions versus the preceding month.

Regarding customer inventories, 10% of participants viewed current levels as “too high.”

Point-of-sale pricing for February was unchanged versus December for 66% of survey participants (24% lower).

“The overall environment for price increases remains notably soft given material demand pressure (declining commodity prices, forex, weaker industrial production) and minimal inflation.”

Anecdotal survey commentary points to continued pressure for fastener-centric distributors in the first half of 2016, with the potential for a more substantive reprieve in the final half of the year. Web: fdisurvey.com

The FDI is a monthly survey of NorAm fastener distributors, conducted by BB&T Capital Markets, along with the FCH Sourcing Network and the National Fastener Distributors Association. As a diffusion index, figures above 50 signal strength, while readings below 50 signal weakness.

Related Stories:

• FIN SURVEY: Moderate Fastener Sales & Profit Gains in 2015

• Fastener Sales Rebound at Fastenal

• Aerospace and Auto Fastener Segment Sales Rise

Related Links:

There are no comments at the moment, do you want to add one?

Write a comment