Stock Report: GRAINGER

FIN STOCK REPORT

Stock Report: GRAINGER

![]()

2014

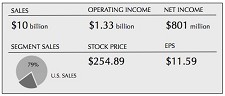

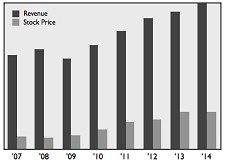

Grainger reported sales, including fasteners, increased 6% to $10 billion in 2014. Net earnings grew 1% to $802 million, while EPS gained 3% to $11.45.

“This was a challenging year, and we were not satisfied with our overall 2014 performance,” stated CEO Jim Ryan. “We addressed several smaller underperforming businesses and believe we have positioned the company for better results going forward.”

During December 2014 Grainger unveiled a plan for its European fastener business, Fabory Group, which the company previously chided for its “soft performance.”

Grainger purchased Fabory in 2011 for $346 million. The previous year, Fabory had generated sales of $295 million, and Grainger hoped that acquiring Fabory, which had 120 locations and more than 1,600 employees, would significantly enhance its presence across Europe.

However, Fabory is currently generating about $280 million in annual income, a sum Grainger called “roughly breakeven” in its November 11 investor presentation.

To improve Fabory, Grainger plans to trim 10-15% of cost out of the business in 2015, which will include branch “rationalization” and “internal process efficiencies.”

In addition, Grainger intends to refocus Fabory on “core fastener growth” by enhancing sales force effectiveness and eCommerce capabilities.

Consolidated Grainger sales in the U.S. rose 7% to $7.9 billion during 2014, while operating earnings grew 10.7% to 1.44 billion.

Full-year sales in Canada contracted 3.5% to $1.07 billion, with segment operating earnings fell 32% to $87.6 million. In Q4 Grainger named Dean Johnson as president of its Canadian business, replacing Eric Nowlin.

Grainger sales rose 5% to $2.4 billion in the first quarter of 2014. Organic sales increased 5%, partially offset by business disruptions from “the extreme weather that closed some customer and Grainger facilities across parts of North America during the months of January and February.”

Q1 operating earnings grew 3% to $354 million.

2013

Grainger reported sales, including fasteners, grew 5.4% to a record $9.4 billion in 2013. Net earnings rose 16% to $797 million and EPS gained 17% to $11.13.

“We made significant investments aimed directly at increasing our scale and accelerating share gains in the large and highly fragmented MRO market,” stated CEO Jim Ryan.

Total U.S. KeepStock installations, including vendor managed inventory, customer managed inventory and vending machines, grew 38 percent, ending the year at approximately 55,000 installations. Sales to KeepStock customers grew at twice the rate of non-KeepStock customers.

In 2013 Grainger surpassed $3 billion in eCommerce sales in 2013, representing 33% of total sales.

Sales in the U.S. climbed 7% to $7.4 billion, driven by “strong sales growth to customers in the manufacturing, retail, natural resources and commercial customer end markets.” U.S. operating earnings rose 15% to $1.3 billion.

Sales at Acklands-Grainger in Canada edged up 0.8% to $1.1 billion, driven by growth in the commercial, trans-portation, light manufacturing and forestry end markets. Operating earnings in Canada grew 1% to $128.8 million.

Sales for the Other Businesses, which includes operations primarily in Asia, Europe and Latin America, increased 3.4% to $1.04 billion in 2013, with segment operating profit down 62% to $7.6 million.

2012

Grainger reported record results for 2012, with sales growing 11% to $9 billion and net earnings increasing 5% to $690 million. Earnings per share of $9.52 increased 5%.

“For the full year, we invested an additional $70 million in expanding our product line and sales force, enhancing eCommerce capabilities, increasing inventory management services and expanding our international presence,” stated CEO Jim Ryan.

Full-year results included:

eCommerce: Posted $2.7 billion in eCommerce sales, representing 30 percent of total company sales and an increase of 23 percent versus the prior year.

Sales Force Expansion: Added 160 new sales representatives and contributed approximately 1 percentage point to company sales growth for the year.

Inventory Management: Increased the number of U.S. customer KeepStock installations by 30%, ending the year at approximately 40,000 installations.

Product Line Expansion: Added more than 80,000 new products to the iconic Grainger U.S. catalog, bringing the total number of products in the 2012 printed catalog to more than 413,000.

International: Surpassed $1 billion in sales in Canada and expanded the company’s presence in Latin America by entering Brazil with the acquisition of AnFreixo.

Capital expenditures for the year rose 27% to $250 million, driven primarily by investments to expand the distribution center network in North America. In May Grainger opened new distribution centers in Patterson, CA, and Saskatoon, Saskatchewan, Canada, bringing its global distribution network to 28 facilities.

The company also used cash to fund two acquisitions, including the December 31 acquisition of Techni-Tool, which reported 2011 sales of $88 million.

Overall fourth-quarter sales gained 7% to $2.2 billion, with net earnings up 5% to $156 million. Q4 earnings per share of $2.17 increased 6%.

On a daily basis, sales increased 6%, with 6% daily sales growth in October, 8% in November and 2% in December. The 6% daily sales growth for the quarter consisted of 3 percentage points from price, 2 percentage points from volume, 1 percentage point from Hurricane Sandy-related sales, and 1 percentage point from acquisitions.

Q4 operating earnings increased 17% to $258 million.

United States (75% of revenue)

Sales in the U.S. increased 5% $1.7 billion during Q4, driven by 3 percentage points from price, 1 percentage point from volume, 1 percentage point from Hurricane Sandy-related sales. U.S. daily sales increased 4% in October, 6% in November and declined 1% in December, with manufacturing, commercial and government customer end markets contributing to the sales growth in the quarter.

Operating earnings in the U.S. segment increased 17% to $276 million, driven by sales growth, higher gross profit margins and positive expense leverage.

By end market: light manufacturing was up in the high single digits; heavy manufacturing and commercial were up in the mid-single digits; and government and retail was up in the low single digits.

Full-year U.S. sales grew 6.5% to $6.92 billion, with operating earnings gaining 6.2% to $1.13 billion.

Canada (13% of revenue)

Fourth-quarter sales at Acklands-Grainger increased 14% to $280.3 million, including 8 percentage points from volume, 4 percentage points from foreign exchange, 1 percentage point from price, and 1 percentage point from sales of seasonal products. The sales increase for the quarter in Canada was led by strong growth to customers in the commercial, construction, oil and gas, and utilities end markets. Q4 operating earnings in Canada increased 2% to $29.9 million.

Full-year Acklands-Grainger sales improved 11.4% to $1.1 billion, with operating earnings up 18.4% to $127.4 million.

Other Businesses (12% of revenue)

Sales for the Other Businesses, which includes operations primarily in Asia, Europe and Latin America, increased 16% to $263.8 million due to strong revenue growth in Japan and the incremental sales from the acquired business in Brazil.

The Other Businesses segment posted a $10.4 million operating loss in Q4 versus a $5.4 million profit in the 2011 fourth quarter.

During the quarter, the company announced structural changes to the businesses in Europe, India and China to improve long-term performance, resulting in $13.7 million in restructuring charges.

Full-year Other Businesses sales improved 55% to $1 billion, with operating income declining 34% to $20.3 million.

Third Quarter

Grainger reported sales increased 8% to $2.3 billion in the third quarter of 2012, with sales on a daily basis gaining 10%, including 3 percentage points from acquisitions and a 1 percentage point decline attributable to unfavorable foreign exchange.

Daily organic sales for the quarter increased 8% — 4 percentage points from volume and 4 percentage points from price.

Third-quarter operating earnings fell 16% to $254 million, dragged down by a $70 million pre-tax reserve recorded in the period for a settlement in principle to resolve pricing disclosure issues relating to government contracts with General Services Administration (GSA) and United States Postal Service (USPS). The proposed settlement, which covers 12 years of sales to the GSA and 10 years of sales to the USPS, remains subject to the approval of the U.S. Department of Justice (DOJ). In addition, the company has established a $6 million pre-tax reserve for resolving tax, freight and miscellaneous billing issues with these government customers.

Excluding the reserve, net earnings increased 11% and earnings per share of $2.81 increased 12%. Including the reserve, reported net earnings for the third quarter decreased 15% to $155 million and earnings per share of $2.15 decreased 14% versus $2.51 in 2011.

“We delivered a solid quarter, with stronger organic sales growth in September than in August and continued to gain market share, expand margins and generate nearly $100 million in operating cash flow over the prior year,” stated CEO Jim Ryan.

Third-quarter sales in the U.S. grew 4% to $1.77 billion, driven primarily by price gains. Solid sales growth and market share gains in the heavy manufacturing, light manufacturing, commercial, government and retail end markets contributed to the sales performance for the quarter.

U.S. operating earnings fell 18% in Q3 to $247 million.

Nine-month sales in the U.S. gained 7% to $5.22 billion, while operating earnings rose 3.2% to $856.7 million.

Q3 sales in Canada grew 10% to $272.9 million, led by strong led by strong growth to customers in the commercial services, oil and gas, forestry, contractor and utilities end markets. Operating earnings in Canada grew 29% to $34.2 million.

Nine-month Canadian revenue increased 10% to $825.4 million, with operating earnings up 25% to $97.5 million.

Overall nine-month sales grew 12% to $6.7 billion, with net earnings up 5% to $534 million.

First Half

Grainger reported record results for the second quarter of 2012, with sales gaining 12% to $2.2 billion, operating earnings rising 18% to $314 million and net earnings growing 12% to $191 million. EPS increased 12% to $2.63 during the period.

Second-quarter sales results included organic growth of 9% (six percentage points from volume and three percentage points from price increases); a five percentage point gain from acquisitions; and a two percentage point decline from unfavorable foreign exchange.

Earnings gains were driven by higher sales, improved gross profit margins and positive operating leverage.

“We are confident that our investments in expanding our product offering, enhancing our eCommerce platform, increasing our sales force and growing our inventory management solutions, provide value to our customers,” stated CEO Jim Ryan.

For the six months of 2012 Grainger sales grew 14% to $4.4 billion, with net earnings increasing 15% to $378 million.

United States

Sales in the U.S. grew 7% to $1.74 billion, driven by 4% volume growth and 3 percentage points from price. Daily sales were up 7% in April, 8% in May and 7% in June. June sales were driven by double digit growth to manufacturing customers as well as strong growth in the government end market.

“For the quarter, the heavy manufacturing, light manufacturing, retail, commercial, government, natural resources and reseller end markets all posted sales growth… while the contractor end market posted a small decline.”

Quarterly operating earnings in the United States increased 15%, with gross profit margins rising 20 basis points driven by price inflation exceeding product cost inflation, partially offset by negative customer and product mix. Expense leverage in the U.S. was positive despite an incremental $24 million in growth-related spending on new sales representatives, eCommerce and advertising.

U.S. sales in the first half of 2012 gained 8.8% to $3.44 billion, with operating earnings up 15.7% to $609.6 million.

Canada

Second quarter sales for Acklands-Grainger — the company’s Canadian business —increased 9%, or 14% in local currency (12% volume growth and 2% from price) to $279.6 million. The sales increase for the quarter in Canada was led by strong growth to customers in the commercial services, oil and gas, contractor and utilities end markets.

Operating earnings in Canada increased 15% to $33.5 million, up 20% in local currency. The strong improvement in operating performance was driven by strong sales growth, a 10 basis point improvement in gross profit margins and positive operating expense leverage.

Acklands-Grainger sales during the first six months of 2012 improved 10.6% to $552.5 million, with operating earnings up 19% to $63.3 million.

Other Businesses

Sales for the Other Businesses, which includes operations in Asia, Europe and Latin America, soared 84% to $249.1 million in Q2, primarily due to the incremental sales from the business in Europe (Fabory) acquired in August 2011, and the business in Brazil (AnFreixo) acquired in April 2012. Excluding acquisitions, sales for the Other Businesses increased 21%, primarily the result of strong revenue growth in Japan.

Operating earnings for the Other Businesses gained 22% to $11 million, boosted by strong earnings growth in Japan and Mexico.

Six-months sales in the Other Businesses category jumped 93% to $488.1 million, with operating earnings up 46% to $22 million.

Based on its first-half performance, Grainger reiterated its 2012 sales guidance of 12% to 14% growth, and increased its EPS guidance to a new range of $10.50 to $10.80.

2011

In May 2012 Grainger opened new distribution centers in Patterson, CA, and Saskatoon, Saskatchewan, Canada, bringing its global distribution network to 28 facilities.

Grainger reported sales, including fasteners, grew 12% to $8.1 billion in 2011, with net earnings gaining 29% to $658 million.

In 2011, Grainger introduced more than 80,000 new products, transacted more than $2 billion in sales through eCommerce and added more than 1,300 net new jobs.

Sales in the U.S. increased 8% to $6.5 billion in 2011, led by a strong increase in the heavy manufacturing customer end market. Operating earnings climbing 16% to $1.07 billion.

Sales in Canada rose 21% to $922.8 million, with operating income more than doubling to $107.6 million.

Sales for the company’s Other Businesses segment, which includes operations in Europe, Japan, Mexico, India, Colombia, China, Puerto Rico, Panama and the Dominican Republic, increased 95% in Q4, largely on the strength of incremental sales from Fabory, which the company acquired on August 31, 2011 for $344 million.

Grainger announced plans to close 25 branches in the U.S. during the 2011 fourth quarter, bringing its yearly closure total to 27 branches.

2010

Grainger reported sales, including fasteners, grew 13% to $1.9 billion in the first quarter of 2011. Sales on a daily basis increased 11% due to an extra selling day in the period.

Q1 operating earnings gained 44% to $263 million, driven by higher gross profit margins and positive expense leverage. Net earnings jumped 59% to $158 million, while earnings per share increased 66% to $2.18 versus.

In 2010 Grainger sales increased 15.4% to $7.18 billion. Daily sales were up 15.9%. For 2010, approximately 10 percentage points of the sales growth came from an increase in volume, 4 percentage points came from business acquisitions, and 2 percentage points due to foreign exchange. Sales to all customer end-markets increased for 2010.

U.S. revenue increased 10.6% to $6.02 billion in 2010, with 9 percentage points of the sales growth coming from an increase in volume. U.S. operating income climbed 25% to $920.2 million.

Sales in Canada grew 26% to $820.9 million, while earnings rose 7% to $46.8 million.

Net sales for other businesses, which include Japan, Mexico, India, Puerto Rico, China, Colombia and Panama, rose 136%.

2009

Grainger reported sales declined 9% to $6.2 billion in 2009, while net earnings fell to $430 million and earnings per share dropped 6% to $5.62.

U.S. revenue decreased 10% to $5.4 billion in 2009, while operating income slipped 12.5% to $735 million.

Sales in Canada dropped 10.4% to $651 million, and earnings fell 19% to $43.7 million.

Grainger plans to open a 1 million sq ft distribution center in Minooka, IL, by 2012, with renovations slated to begin in 2010. The new facility is expected to house more than 450,000 industrial supply items, with a staff of 400 warehouse and logistics employees.

“Opening a new distribution center southwest of Chicago will allow us to deliver more products next-day to our Midwest customers,” said Tommy Kersting, Grainger’s local distribution director.

At the end of November the Canadian division of Grainger acquired the assets of the K&D Pratt Industrial Division, with facilities in Darmouth, Nova Scotia; St. John’s, Newfoundland; and Saint John, New Brunswick.

In October 2009, Grainger paid an estimated $60 million for fasteners and trucking supply distributor Imperial Supplies, which has distribution centers in Green Bay; Charlotte, NC; Dallas, TX, and Reno, NV.

2008

Grainger said sales grew 6.7% to a record $6.85 billion in 2008, with net income gaining 13% to $475.3 million.

Branch-based sales, which include revenue from the U.S., Mexico and China, climbed 6.1% to $5.7 billion in 2008, while operating income gained 16.9% to $782.7 million. Sales at Canada-based Acklands-Grainger increased 14.4% to $728 million, and earnings grew 22% to $54.3 million.

But sales slipped 12% in the opening quarter of 2009, including a 10% drop in U.S. revenue to $1.3 billion. Sales in Canada declined 19% to $143.8 million.

“We do not believe that we’ve seen the bottom to the sales decline and expect increased pricing pressure throughout the remainder of the year,” stated CEO Jim Ryan. The company reduced headcount by 200 employees, on track to meet workforce reductions of 300-400 in 2009.

During 2008 Grainger’s Canadian subsidiary, Acklands – Grainger, acquired Excel Industriel of Granby, Quebec. Excel is a business-to-business broad line distributor of fasteners and other MRO supplies. Grainger expects an incremental sales contribution of $11 million from this acquisition in 2009.

Grainger also announced plans to expand its operations throughout the Gulf region by revamping its distribution network to open four new facilities and relocate one other. Grainger intends to increase its local workforce by approximately 35% and nearly double the size of its distribution network in the area.

In addition, the company established its first branch in Panama, opening a second expansion market in Latin America.

HISTORY

Grainger significantly expanded its fastener offerings in 2005, undertaking the biggest product expansion in its 78-year history by adding more than 25,000 fastener SKUs. Grainger’s 4,007-page catalog in 2006 featured 260 pages on fasteners. The company is banking on fasteners to boost its average order total above $200.

Grainger supplies 2 million customers in the U.S. Canada, Mexico and China through more than 600 branches and 28 distribution centers.

Corporate Office: 100 Grainger Parkway, Lake Forest, IL 60045-5201. Tel: 847 535-1000

Web: grainger.com

CEO: James Ryan

Employees: 23,741

©2014 GlobalFastenerNews.com

Related Links:

• Grainger

There are no comments at the moment, do you want to add one?

Write a comment