Stock Report: DORMAN PRODUCTS

FIN STOCK REPORT

Stock Report: DORMAN PRODUCTS

![]()

2014

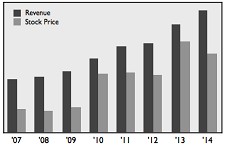

Dorman Products, Inc. reported sales, including fasteners, increased 2% to $174 million for the fourth quarter of 2014.

The company said its Q4 sales growth rate would have been 9% except for $5.9 million in incremental costs associated with the ERP conversion, consisting of $2.8 million in increased distribution costs, $1.9 million in consulting and other related support costs, $0.5 million in additional depreciation and $0.7 million in other costs.

“The sales growth rate in the second half of 2014 was negatively impacted by softer order patterns from two customers that chose to reduce inventory levels,” said CEO Steve Berman. “Growth rates for the rest of the business were in the low teens, which were down slightly from historical levels. Additionally, sell-through rates of our products were strong in the fourth quarter, but down slightly from third quarter levels.”

Full-year sales including fasteners, increased 13% to $751.5 million. Diluted earnings per share rose 11% to $2.49. R&D spending increased 18% to $15.8 million.

Dorman Products reported first-quarter 2015 sales, including fasteners, rose 3% to $188.5 million.

2013

Dorman Products reported sales, including fasteners, increased 19% to $183.5 million in the first quarter of 2014. Net income from continuing operations grew 23% to $23.6 million, or $0.64 per diluted share. Gross profit margin declined to 39% from 39.4%.

Dorman Products reported its fifth consecutive year of double digit growth, with sales – including fasteners – up 16% to a record $664.5 million in 2013. Operating income jumped 23% to $127.9 million, while net income gained 15.4% to $81.9 million. Gross profit margin increased to 39.3% from 37.7%.

Fourth quarter sales rose 26% $169.8 million, driven by strong demand for our new products. Net income jumped 35% to $20.6 million, or $0.56 per diluted share. Q4 gross margin edged up to 38.9% from 38.4%.

In May 2013, Dorman Products paid $3.7 million for Re-Involt Technologies, LLC, a remanufacturer of hybrid battery systems. Four months later, Dorman Products launched its Hybrid Drive Battery program.

2012

Dorman Products reported sales, including fasteners, rose 15% to $154.4 million in the first quarter of 2013.

Net income from continuing operations grew 25% to $19.1 million, or $0.52 per diluted share.

Dorman Products reported its fourth consecutive year of double digit growth, with sales, including fasteners, gaining 11% to $570.4 million in 2012. Net income gained 18% to $66.4 million.

Fourth quarter sales dipped slightly to $135 million, hurt by a planned one-time $5.1 million reduction in orders to remove inventory from a large customer’s supply chain. Net income remained unchanged at $15.2 million., or $0.42 per diluted share.

During 2012 Dorman liquidated its Swedish business, resulting in a one-time $3 million non-cash currency translation gain and $1.4 million in benefits from foreign tax credits as a result of the liquidation.

2011

Dorman Products achieved its fourth consecutive year of revenue and earnings growth in 2011, with sales, including fasteners, rising 16.1% to $529.3 million. The company achieved a “record net profit” of $55.8 million before one-time expenses.

“Industry trends have been favorable.”

Dorman said revenue growth was driven by “overall strong demand for our products, higher new product sales and the impact of one additional week’s sales” in 2011.

Demand was bolstered by “favorable” industry trends. During the recession the auto dealership market consolidated, reducing Dorman’s prime competition.

“In addition, over the past several years consumers have been holding onto their vehicles longer. As a result, the average age of vehicles on U.S. roads in 2011 was at an all-time high of 10.8 years. Older vehicles mean increased sales of automotive replacement parts.”

During 2011 Dorman increased its workforce by 16% to an overall employee headcount of 1,265.

“It is our belief that we can continue to grow profitably by identifying and introducing new products, creatively marketing such products, and sourcing them competitively,” stated CEO Steven Berman.

2010

Dorman Products reported sales, including fasteners, rose 27% to $122.5 million during the fourth quarter of 2010, while net income increased 58% to $12.2 million.

Full-year revenue gained 20.8% to $455.7 million, driven by “strong overall demand for our products and higher new product sales.” Net income soared 74% to $46.1 million.

“Dorman’s strong revenue and earnings growth in the fourth quarter and full year were driven by the introduction of a record number of new parts during 2010, and continued market penetration of formerly dealer-only products that were introduced in recent years,” stated CEO Steven Berman.

“During 2010 we continued to invest in product development, engineering and sales resources. We expect these investments to further increase our industry-leading level of new product introductions in the years to come.”

2009

Dorman Products continued growing its revenue, with 2009 sales rising 10% to $377.4 million, “driven by strong overall demand for our products and higher new product sales.”

Full-year net income jumped 49% to $26.5 million.

Those results include a strong fourth quarter performance, as revenue increased 20% to $96.7 million and Q4 income soaring 57% to $7.7 million.

In 2009 the company boosted new product development.

“We are compelled to make hard decisions. This means we will discontinue unprofitable product lines and say no to new sales opportunities that do not provide an adequate return on investment. Our focus for 2009 and beyond is not simply to grow revenue; it is on profitable, enduring, and mutually beneficial growth for us and our customers.”

2008

Dorman Products followed its 2007 double-digit sales growth with a 4.5% revenue gain to $342.3 million during 2008, driven by “higher new product sales and increased market penetration.” Net income dipped 7% to $17.8 million.

HISTORY

In 2006 R&B Inc. changed its named to Dorman Products Inc. to “present a sharper image of the company and strengthen its corporate identity by connecting it directly to the company’s strongest brand.” R&B purchased Dorman Products in 1994.

All products are now sold under one of seven Dorman sub-brands. Automotive fasteners are sold under its Auto Grade sub-brand.

Dorman designs, packages and markets 103,000 automotive replacement parts and fasteners, with about 30% of its business coming from OEMs. Customers include AutoZone, Pep Boys, Advance, NAPA, Wal-Mart, Carquest, AutoValue, Home Depot, Lowe’s, salvage yards and local independent wholesalers.

Dorman operates warehouse and office facilities in the U.S., Canada, China and India. Domestic warehouses are located in Warsaw, KY; Colmar, PA; Louisiana, MO; Baltimore; and Portland, TN.

Corporate Office: 3400 E. Walnut St., Colmar, PA 18915. Tel: 215 997-1800 Fax 215 997-7968

Web: dormanproducts.com

CEO: Steven Berman

Employees: 1,785

©2015 GlobalFastenerNews.com

There are no comments at the moment, do you want to add one?

Write a comment