2014 Brings Solid Returns for Fastener Companies

FEATURES

![]()

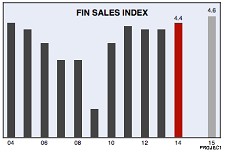

For the fourth year in a row a majority of fastener companies participating in the End of 2014 FIN Survey reported solid results, with widespread sales and profits gains and mostly moderate costs increases.

Just under seven in ten businesses reported “moderate” to “strong” sales growth in 2014.

About 64% of fastener manufacturers, importers, distributors and platers reported increased profits.

The End of 2014 FIN Survey found costs edged up modestly. And 55% of businesses reported a “moderate” to “strong” increase in capital expenditures during 2014.

Much of the same is expected this year, with a solid majority of FIN Survey participants forecasting higher sales and profits amid moderate cost increases for 2015.

Manufacturers: A strong majority of fastener manufacturers reported steel prices were flat over the past six months, while finished goods and raw material inventories as 2015 began were largely up from a year before.

Fastener manufacturers reported operating at a range from 40% of capacity to 98% in 2014, with an average of 70.5%.

Distributors: Distributors reported fasteners were predominately available in 2014, with 62% of distributors claiming no problems obtaining fasteners, down from 82% claiming no difficulty the previous year.

About 39% reported moderate to significant difficulty obtaining certain fasteners in 2014.

For the second straight year, distributor gross margins improved. Gross margins reported by distributor respondents ranged from 12% to 60%.

Fastener Prices: The majority of fastener businesses successfully raised prices in 2014. Price increases ranged from 1% to 20%, with an average increase of 4.75%.

For 2015, 56% of businesses forecast price gains — up two percentage points from last year — while 21% anticipate no price changes this year and nearly two in ten fastener companies are “unsure.”

Job Market: Fastener job growth increased in 2014. After hovering near 50% for two years, 61% of fastener companies added jobs in 2014.

Just under three in 10 survey participants (29%) held the line on their workforce. And only 6% of FIN Survey respondents reported job cuts.

More than half of fastener companies (51%) predict job growth in 2015, while 4% anticipate cutting jobs.

Wage increases continued in 2014, with 83% giving raises averaging 1% to 4%.

And seven in ten survey participants anticipate modest pay raises in 2015.

Economic confidence: Economic confidence is up for 2015. Just shy of a majority of FIN Survey participants had “Very High” (4%) or “High” (44%) ratings for the North American economy for 2015. Another 46% rated their confidence level at “Moderate.”

The confidence is up from the end of 2013.

For the global economy, a 51% majority of End of 2014 FIN Survey respondents pegged their confidence at “Moderate.”

Participants

Distributors totaled 46% of the End of 2014 FIN Survey; manufacturers 36%; importers 11%; and “others” 5%.

• The number of plants / warehouses ranged from one to 20.

• Employment ranged from one to 2,500.

The FIN Survey is informal and not designed to be a scientific survey.

Full results of the End of 2014 FIN Survey are available to subscribers by clicking here.

Non-subscribers can purchase a FIN Survey summary on the Article Store.

Related Stories:

There are no comments at the moment, do you want to add one?

Write a comment