FDI: February Distribution Slows

3/6/2013 12:02:00 AM

FEATURE

What impact might MSC buying Barnes Distribution have?

“MSC Industrial has sought ways to access fasteners, and BDNA would seem to provide that entree. But what did respondents think?”

“Most did not think much: 36% imagined MSC would be more competitive in fasteners, but 64% did not see much impact on the market.”

“However, even in this there is a cautionary tale for smaller distributors. Of the distributors who imagined no impact, 76% based this on never having run into Barnes, not MSC’s inability to tackle the model.”

“But one of the things MSC brings to the transaction is a wider reach. It still has to prove it can be effective in fasteners, but this suggests to us there is a real geographic opportunity.” Click here for more.

In like a lion, out like a lamb.

That’s how U.S. fastener distributors may come to remember the opening quarter of 2013.

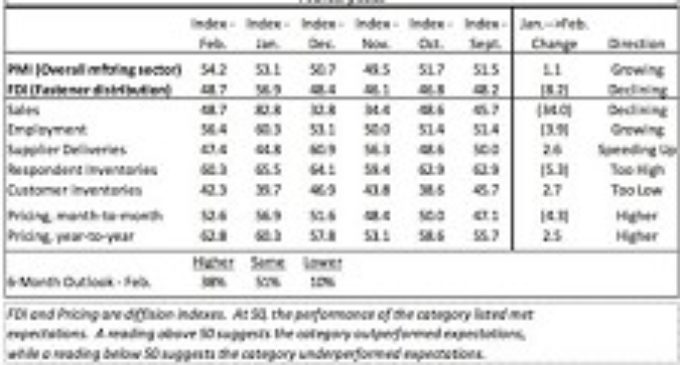

Fastener activity in the first two months of 2013 suggests an unwelcome trajectory for U.S. distribution, as business advanced in January and retreated somewhat the following month, according to the BB&T Capital Markets Fastener Distributor Index (FDI).

“After a resurgent January, February skidded to levels that question the strength of the early 2013 bounce,” according to the FDI.

The FDI sales index “returned to slow/no growth mode” in February, dropping to 48.7 from January’s 56.9.

“After a resurgent January, February skidded to levels that question the strength of the early 2013 bounce. The main mover, again, was sales… Other components were stable.”

Analysts for the FDI said they weren’t surprised by the decline itself, but specifically by how it diverged from the broad Purchasing Manager’s Index (PMI), which improved in February.

Such lackluster results tempered “euphoria” about the coming months, with “optimists” — the 38% of survey respondents who forecast higher activity in six months — outpacing “pessimists” — the 10% of survey participants estimating lower activity in the coming months.

“Mostly the camp seeing things being the ‘same’ swelled, to 51% of the total. This still ranks as a good reading, but definitely more cautious and guarded than we have seen of late.”

And pricing in February? The FDI found it “mind-numbingly marginal.”

“After a hopeful January, February sequential pricing settled back toward the no change level. Higher year-over-year pricing is still the norm, but at this point it seems to be in the very low single digit zone. Any apparent improvement seems to have been nothing but a feint, as pricing in the fastener industry remains largely directionless.”

The FDI is a monthly survey of North American fastener distributors. As a diffusion index, readings above 50 signal strength and below 50 signal weakness.

The FDI is a joint production of BB&T Capital Markets and the FCH Sourcing Network, the online network for industrial fasteners. ©2013 GlobalFastenerNews.com

Related Stories:

• How To Save Your Fastener Company Money

• Where Are Fastener Prices Headed?

There are no comments at the moment, do you want to add one?

Write a comment